How to Measure Stand Alone Risk

Returns earned over a given time period are called realized returns. The Standard Deviation σmeasures the tightness or variability of a set of outcomesthat is σ measures the tightness of a probability distribution.

Assessing Stand Alone Risk Boundless Finance

1 Define stand-alone risk and within-firm risk.

. If you or your executives choose to look at reputation as a stand-alone risk there are two possible methods for assessing reputation. It is easy to measure the standalone risk of a new delivery truck or a home improvement warehouse as there are numerous quantitative techniques such as scenario analyses sensitivity analyses and Monte Carlo simulations. Analysts across companies use realized stock returns to estimate the risk of a stock.

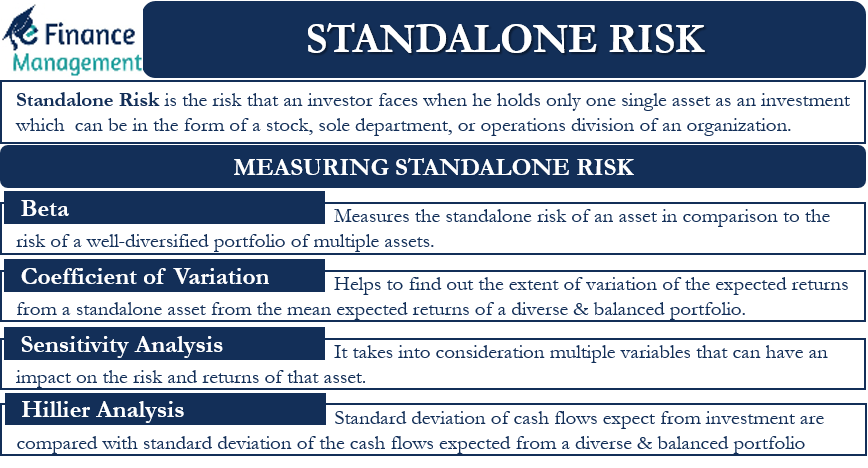

Standalone risk can be measured with a total beta calculation or through the coefficient of variation CV. This week we will define a statistical measure of stand-alone risk as being the standard deviation of returns. The assets risk is in fact measured in two categories that are standalone risk and portfolio risk.

Several techniques are used to assess the stand-alone risk which reflects the uncertainty about the projects cash flows. We will describe three alternative attitudes towards risk settling on risk aversion as being the standard assumption made in financial markets. Let me say this first about computer modeling.

The Standard Deviationmeasures the tightness or variability of a set of outcomesthat is a probability distribution. One of the most common methods of determining the risk an investment poses is standard deviation. 4 Learn how to measure stand-alone risk and learn the benefits of knowing a projects stand-alone risk.

Consider the case of Falcon Freight Inc. Historical data on realized returns is often used to estimate future results. It is calculated as the.

We will describe three alternative attitudes towards risk settling on risk aversion as being the standard assumption made in financial markets. The tighter the distribution the less the variability of the outcomes and the less. 3 Identify decision makers who are concerned about stand-alone risk and within-firm risk.

Stand-alone risk measures the undiversified risk of an individual asset. The tighter the distribution the less the variability of the outcomes and the less risk associated with. Investors can include different kinds of stocks or assets and create a balanced portfolio.

Statistical measures of stand-alone risk Remember the expected vadocx from ECON ECONOMETRI at Porsa Public School. Standard deviation helps determine market volatility or the spread of asset prices from their. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

Individual standard deviation Individual variance Individual coefficient of variance etc. Measuring stand-alone risk using realized historical data. The coefficient of variation is a better measure of stand-alone risk than standard deviation because it is a standardized measure of risk per unit.

We will then analyse the impact of combining assets into a portfolio upon both risk and. If your organization doesnt or cant do this with internal resources then please talk to someone who does data crunching all. This will help them to.

Measuring Standalone Risk. Table of Contents0007 - What is investment risk0053 - Probability Distributions0159 - Lets calculate RISK0400 - Summary of results0432 - Coefficient. 1 sensitivity analysis 2 scenario analysis and 3 Monte Carlo simulation.

Sensitivity analysis measures a projects stand-alone risk by showing how much the projects NPV or IRR is affected by a small change in one of the input variables say sales. Investors should thoroughly assess the standalone risk of their investment. The compensation of expected risk should be kept in mind for a dealing a certain capital ensuring the high returns on the capitals.

Some of these techniques are. This article throws light upon the top four methods of measurement of risk. Though in portfolio few risks have to be addressed but the standalone risk assessment is required for one specific asset in that portfolio.

An assets stand-alone risk is the risk an investor would face if he or she held only this one asset. 2 Emphasize that well-diversified investors are only concerned with non-diversifiable risk beta risk. Stand-alone risk is the risk an investor would face if he or she held only _____ one asset.

Scenario analysis and modeling. They may also minimize this risk by efficient diversification of their portfolio. They can measure its beta coefficient of variation or use other measures as mentioned above.

An asset stand-alone risk considers the total of. Other things held constant with the size of the independent variable graphed on the horizontal axis and the NPV on the vertical axis the steeper the graph of the relationship line. Defining Attitudes Towards and Alternative Measures of Risk This week we will define a statistical measure of stand-alone risk as being the standard deviation of returns.

Hence it is more likely to estimate standalone risk qualitatively.

Chapter 5 Risk And Rates Of Return Ppt Video Online Download

Comments

Post a Comment